Automating tax notices

Role Design Manager and Individual contributor | Work done Strategy, Interaction design | Others in team 1 Junior Interaction designer, 1 Content designer

BACKGROUND Our big hairy audacious goal that this team wanted to achieve was to to serve more customers with our expert services, and serve them better. We want to do this at scale to support our 1M customers. We started by looking at what are the most important expert services which need our attention first. This is when we unearthed the big problem of our customers receiving tax notices.

What are tax notices?

A written communication sent by the IRS, states, and local taxing agencies to alert a business owner of any discrepancy in payroll tax payment or payroll tax filing. Intuit’s payroll tax operations team supports over 2K~ different notice types (50 states, IRS, and >3k state localities) that our customers get.

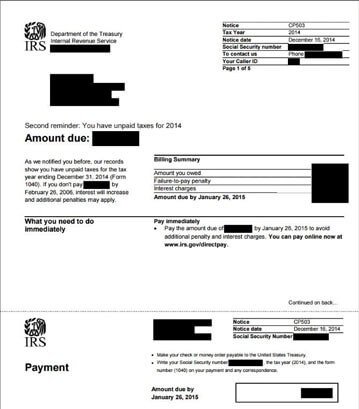

An example of a tax notice from the federal agency

This is what a tax notice looks like. This is sent via post and no electronic communication is sent from any of the agency.

Every year, Intuit receives around 35k tax notices from customers who use our full-service payroll offerings. A team of ~25 experts resolves these notices by researching the issue using up to 8 different internal tools and contacting the tax agency representatives. The resources made available by Federal and State agencies are limited and make it difficult for us to resolve notices more efficiently - for e.g. the experts face 1-2 hours of waiting times on calls to agency representatives and there is a limit of up to 5 notices that can be discussed in one call.

RESEARCHWhat customers do when they receive a tax notice from an agency

When a QuickBooks Payroll customer receives a tax notice, they expect to get help from Intuit given we file and pay their taxes as a ‘Full-Service payroll’ provider. However, there was no in-product document solution that would deliver a Tax Notice to the Payroll Tax Team to work or resolve for the customer. All documents needed to be sent via an outdated email process. After that, the customers had to wait till they receive an email with the resolution. Getting a resolution email took up to 21 days on average, and during this time, the customers didn’t have any way to get an update on what was happening with their notice creating stress, anxiety and ultimately frustration towards Intuit.

The journey line for a customer and tax ops agent created after research

What our customers said during research

I remember getting that tax notice in the mail. I remember freaking out. And I remember calling my accountant saying ‘What do I do?!’ She said to me “Isn’t there an email address where you can submit the form to them, so that they can research it and get back to you?” and there was! And pretty sure I submitted it but I don’t think I ever got a response, and I’ve actually gotten a couple of subsequent notices in the mail since then

When we measured the PRS of our existing process it was an absymal -90 (that’s right, it was negative)

VISION AND GOALVISION Deliver on the promise of ‘Worry-free taxes’ with a hassle-free and delightful tax notice resolution service

GOAL Dramatically improve the customer experience of our Tax Notice Service by automating all state tax notices, consolidating agent tools, and improving chat communication and appointment management as measured by improving the PRS from -90 to +10 for Tax Notice Review Expert Service.

Introducing our industry first patent pending technology

In-Product Upload - Customers can now find a ‘Tax Notice’ link in Payroll Tax Center. Clicking on this opens the QB Assistant - a bot greets them and provides them an option to upload their notice. Once uploaded, the document is read using an ML model. The output of the ML model is processed using a Knowledge Engine that stores the business rules, to decide what action should be taken on the document and what message should be displayed to the customer.

Instant Resolution - For notices that require the customer to update their tax data, the bot informs the customer what the notice requires them to do and tells them the steps to make the changes in Payroll Settings. Customers can self-serve and we don’t require any expert involvement for such notices anymore.

Please reach out for a complete walk through of the end to end design

RESULTSThe most innovative component of this solution is the Document Comprehension part, which includes an ML model that reads the notice document uploaded by the customer and a Knowledge Engine that applies the business rules to decide the next action for the notice. This component is industry-first and we’ve filed for a patent for it with the name “Intelligent Document Processing”

No other payroll provider in the industry is offering automatic tax notice resolution. Our competitors such as Gusto, ADP, and Paychex offer a set of manual steps for the customers to ask for help. This makes this solution industry first.

Our PRS also jumped to a +24 from a -90

Media mentions

PC Mag when reviewing QuickBooks Payroll talked about the new Tax notice experience

Intuit has added a particularly useful tool. Employers can now upload IRS notices they’ve received into QuickBooks Payroll and receive assistance and updates on the notice’s status. No one else offers this.

What we are doing next - Sneak peek

We are working on an ability for our customers to upload the notices by taking a picture on the phone and having AI work with images as well